All Categories

Featured

Consider Utilizing the penny formula: cent means Financial debt, Revenue, Mortgage, and Education. Complete your financial obligations, home mortgage, and college expenditures, plus your income for the number of years your household requires defense (e.g., until the youngsters are out of your home), and that's your insurance coverage need. Some economic experts determine the amount you need using the Human Life Value approach, which is your lifetime earnings possible what you're making now, and what you expect to gain in the future.

One means to do that is to try to find business with solid Financial strength ratings. term level life insurance. 8A firm that underwrites its own plans: Some firms can market policies from another insurance provider, and this can include an added layer if you wish to change your policy or in the future when your household needs a payout

Level Term Life Insurance

Some firms provide this on a year-to-year basis and while you can anticipate your prices to climb considerably, it might be worth it for your survivors. One more method to contrast insurance policy business is by considering online client reviews. While these aren't most likely to inform you a lot about a business's monetary security, it can inform you exactly how easy they are to work with, and whether cases servicing is an issue.

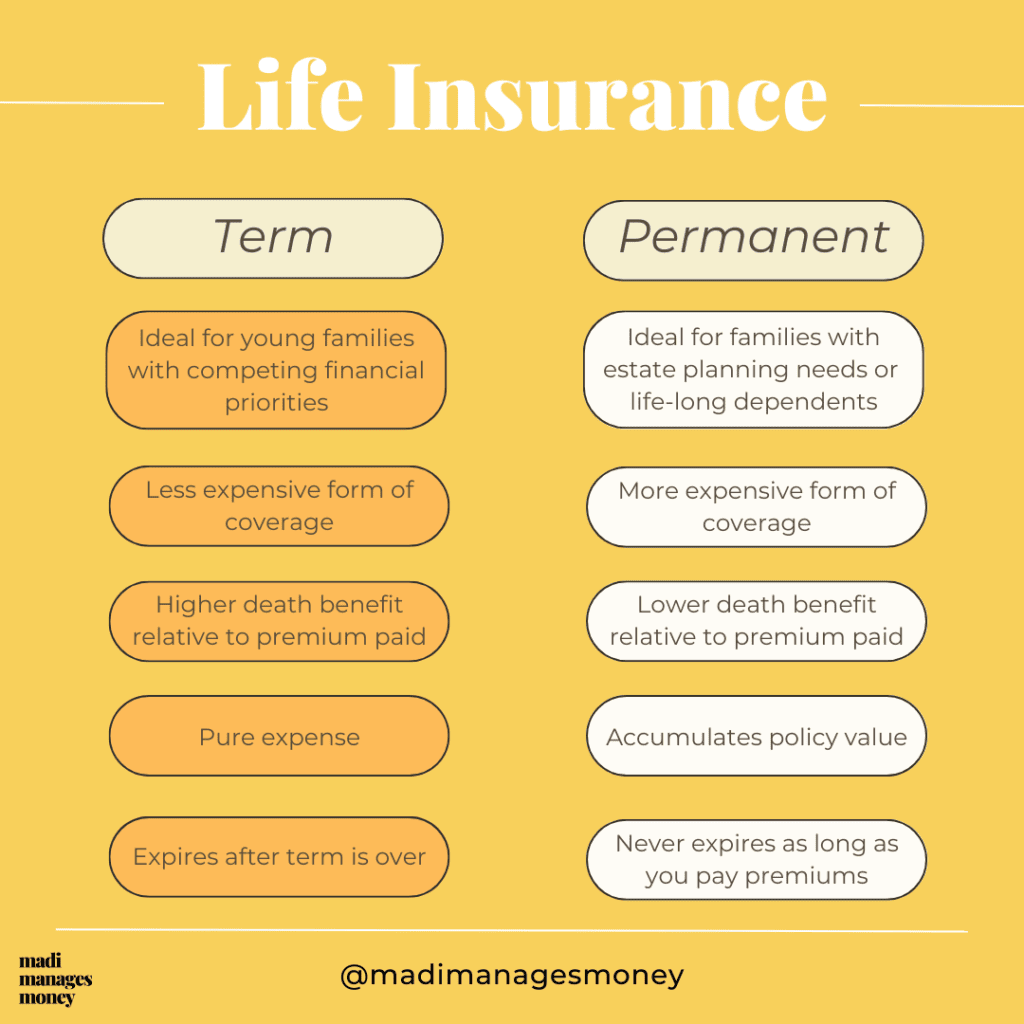

When you're younger, term life insurance policy can be a simple means to shield your liked ones. Yet as life changes your monetary top priorities can also, so you might wish to have entire life insurance coverage for its life time protection and fringe benefits that you can use while you're living. That's where a term conversion is available in - which of the following life insurance policies combined term.

Approval is ensured despite your health and wellness. The premiums will not enhance when they're set, yet they will certainly rise with age, so it's a good idea to lock them in early. Figure out more about just how a term conversion works.

1Term life insurance policy offers short-term protection for a critical duration of time and is typically cheaper than permanent life insurance. what is 10 year level term life insurance. 2Term conversion guidelines and restrictions, such as timing, may use; for instance, there may be a ten-year conversion benefit for some products and a five-year conversion opportunity for others

3Rider Insured's Paid-Up Insurance policy Purchase Option in New York. There is a cost to exercise this rider. Not all participating policy owners are eligible for dividends.

Latest Posts

Which Of The Following Is Not A Characteristic Of Term Life Insurance

Is Direct Term Life Insurance Good

Family First Life Final Expense